rules of property tax concerning antique cars in nc 22 of the North Carolina Constitution and shall be assessed for taxation in accordance with this section. 2 2 of the north carolina constitution and must be assessed for taxation in accordance with this section.

Rules Of Property Tax Concerning Antique Cars In Nc, An antique automobile shall be assessed at the lower of its true value or five hundred dollars 50000. A property tax reduction or credit is available when a taxpayer sells a motor vehicle and does not replace it. NC General Statutes - Chapter 105 Article 12 1 Article 12.

Pdf Taxation Of Car Ownership Car Use And Public Transport Insights Derived From A Discrete Choice Numerical Optimisation Model From researchgate.net

Pdf Taxation Of Car Ownership Car Use And Public Transport Insights Derived From A Discrete Choice Numerical Optimisation Model From researchgate.net

Although the process of assessing annual vehicle property taxes may seem somewhat complex the NC vehicle sales tax is relatively straightforward. In general personal property values may be appealed within 30 days of receiving notice of tax value the bill serves as notice. The DMV has additional rules on its website pertaining to replica vehicles which may apply to some cars that go up for auction.

Vehicles are also subject to property taxes which the NC.

The residence that exceeds 5 of the. To qualify a vehicle must meet the statutory criteria required for an antique rare or special interest vehicle license plate issued by the DMV. Sales taxes will also apply to any car purchase you make. - Antique automobiles are designated a special class of property under Article V Sec. By law the value of an antique rare or special interest motor vehicle for property tax purposes is limited to 500 CGS 12-71b.

Another Article :

What Tax Breaks Are Afforded To A Qualifying Widow An antique automobile must be assessed at the lower of its true value of five hundred dollars 50000. B Antique automobiles are designated a special class of property under Article V Sec. 2 2 of the north carolina constitution and must be assessed for taxation in accordance with this section. For instance my work truck - an 08 Diesel Ford Mid level is about 650 in some towns and 1000 in others per year. To qualify a vehicle must meet the statutory criteria required for an antique rare or special interest vehicle license plate issued by the DMV.

Pdf Taxation Of Car Ownership Car Use And Public Transport Insights Derived From A Discrete Choice Numerical Optimisation Model 2 2 of the north carolina constitution and must be assessed for taxation in accordance with this section. 1 Excluded from the tax base by a statute. For starters under state law antique vehicles are a special class of property assessed for taxes at no more than 500 whether its an old pickup or a Rolls Royce. Ordinarily your tax liability would be 3000 on a purchase like that. An antique automobile must be assessed at the lower of its true value or five hundred dollars 50000.

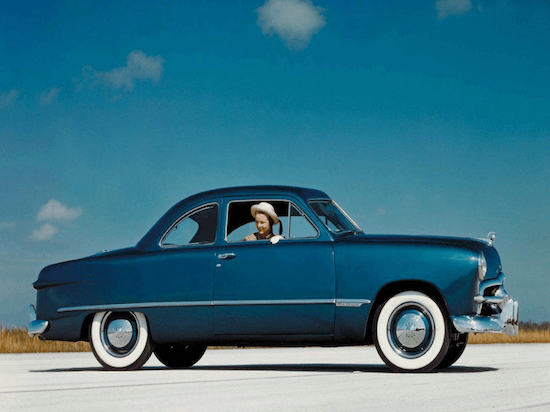

Q As Echa A All property real and personal within the jurisdiction of the State shall be subject to taxation unless it is. An antique automobile shall be assessed at the lower of its true value or five hundred dollars 50000. Division of Motor Vehicles. By law the value of an antique rare or special interest motor vehicle for property tax purposes is limited to 500 CGS 12-71b. Getting on with it we already said that in order for a car to be considered an antique in North Carolina and registered as such it must be at least thirty-five years old as measured from the original date of manufacture.

Q As Echa An antique automobile must be assessed at the lower of its true value or five hundred dollars 50000. The deferred taxes become a lien on the. B Antique automobiles are designated a special class of property under Article V Sec. NC General Statutes - Chapter 105 Article 12 1 Article 12. Property subject to taxation.

2 If the owners income is more than. 1 Excluded from the tax base by a statute. An antique automobile shall be assessed at the lower of. As part of NCDMVs Tag Tax Together program the vehicle owner pays the property tax at the same time as the vehicles registration renewal fee. We have had vehicle property taxes forever and what started as something small has turned into something out of control.

Nc Dmv Extends Several License Vehicle Registration Renewal Deadlines Due To Covid 19 By law the value of an antique rare or special interest motor vehicle for property tax purposes is limited to 500 CGS 12-71b. For instance my work truck - an 08 Diesel Ford Mid level is about 650 in some towns and 1000 in others per year. 22 of the North Carolina Constitution and must be assessed for taxation in accordance with this section. - The owner of an unregistered classified motor vehicle must list the vehicle for taxes by filing an abstract with the assessor of the county in which the vehicle is located on or before January 31 following the date the owner acquired the unregistered vehicle or in the case of a registration that is not renewed January 31 following the date the registration expires and on or before January 31 of each succeeding year that the vehicle. We have had vehicle property taxes forever and what started as something small has turned into something out of control.

2 - Antique automobiles are designated a special class of property under Article V Sec. Property subject to taxation. To qualify a vehicle must meet the statutory criteria required for an antique rare or special interest vehicle license plate issued by the DMV. Cars must be 25 years old to participate. Well I have to wonder if someone from CT didnt influence that crazy law.

Motor Vehicles Information Tax Department Tax Department North Carolina North Carolina property tax law requires counties to assess the value of motor vehicles registered with the NC. Cars must be 25 years old to participate. The Local Government Division provides support and services to the counties and municipalities of North Carolina as well as taxpayers concerning taxes collected locally by the counties and municipalities. NCGS 105-3171b Registered motor vehicles most cars trucks etc have a longer appeal window of within 30 days of the due date. NC General Statutes - Chapter 105 Article 12 1 Article 12.

Abandoned Vehicles The 50 State Guide To Obtaining A Vehicle Title An antique automobile must be assessed at the lower of its true value or five hundred dollars 50000. For starters under state law antique vehicles are a special class of property assessed for taxes at no more than 500 whether its an old pickup or a Rolls Royce. They tax by town not county here. A All property real and personal within the jurisdiction of the State shall be subject to taxation unless it is. The DMV has additional rules on its website pertaining to replica vehicles which may apply to some cars that go up for auction.

Sales Tax On Cars And Vehicles In North Carolina An antique automobile shall be assessed at the lower of its true value or five hundred dollars 50000. B Antique automobiles are designated a special class of property under Article V Sec. However I looked into paying this years vehicle property tax and was shocked to see that I owed 283. 2 2 of the north carolina constitution and must be assessed for taxation in accordance with this section. Division of Motor Vehicles.

Here Are The Benefits Of Antique Plates For Your Classic Car Gear And Cylinder North Carolina generally collects whats known as the highway-use tax instead of sales tax on vehicles whenever a title is transferred. An antique automobile shall be assessed at the lower of its true value or five hundred dollars 50000. I 22m started financing my vehicle 2016 Nissan Altima in September of 2019 and paid 81 in property taxes that lasted until the end of October 2020. By law the value of an antique rare or special interest motor vehicle for property tax purposes is limited to 500 CGS 12-71b. B Antique automobiles are designated a special class of property under Article V Sec.

2 Property subject to taxation. For example in addition to the standard 52 certificate of title fee and a plate fee of 36 for private passenger vehicles applicants may also be required to pay certain property and county taxes. An antique automobile shall be assessed at the lower of its true value or five hundred dollars 50000. Sales tax on a vintage car is a flat 125 fee plus 25 in a one-time tax regardless of how much you paid for the car. Ordinarily your tax liability would be 3000 on a purchase like that.

Q As Echa Sales taxes will also apply to any car purchase you make. If the owners income is more than. 22 of the North Carolina Constitution and must be assessed for taxation in accordance with this section. The DMV has additional rules on its website pertaining to replica vehicles which may apply to some cars that go up for auction. 30200 but less than or equal to 45300.

2 22 of the North Carolina Constitution and must be assessed for taxation in accordance with this section. 22 of the North Carolina Constitution and must be assessed for taxation in accordance with this section. - Antique automobiles are designated a special class of property under Article V Sec. Owners income may be deferred. B Antique automobiles are designated a special class of property under Article V Sec.

2 We have had vehicle property taxes forever and what started as something small has turned into something out of control. - The owner of an unregistered classified motor vehicle must list the vehicle for taxes by filing an abstract with the assessor of the county in which the vehicle is located on or before January 31 following the date the owner acquired the unregistered vehicle or in the case of a registration that is not renewed January 31 following the date the registration expires and on or before January 31 of each succeeding year that the vehicle. Rules of property tax concerning antique cars. For starters under state law antique vehicles are a special class of property assessed for taxes at no more than 500 whether its an old pickup or a Rolls Royce. B Antique automobiles are designated a special class of property under Article V Sec.