how does kansas assess sales tax on antique cars Add any vehicle improvement costs to the adjusted purchase price. In addition there is a county registration fee of 500 for a.

How Does Kansas Assess Sales Tax On Antique Cars, Do Kansas vehicle taxes apply to trade-ins and rebates. Standard antique registrationlicense plate fee is a one-time 40 fee. Cost- 4500 registration fee in addition to personal property tax and sales tax.

Cash For Cars Kansas City Get 480 11 000 Cash For Car From cashforcars-junkcars.com

Cash For Cars Kansas City Get 480 11 000 Cash For Car From cashforcars-junkcars.com

For most vehicles Fairfax County has chosen to use the clean trade-in value as listed in the pricing guide. If a personalized antique plate is requested there will be an 4550 charge in addition to the 40 registration fee. Antique registration means that you pay 25 once for an inspection and never have to pay for it.

Delaware gets good marks for sales tax but it does charge a Documentation Fee which is 45 percent of the vehicle sale price or the NADA value whichever is higher.

Dealer Kansas Department Of Revenue. Notice 09-05 Manufacturers rebate on the purchase or lease of new motor vehicles. Subtract what you sold the car for. As of 2012 the state sales tax rate was 63 percent and counties and some. Montana Alaska Delaware Oregon and New Hampshire.

Another Article :

Missouri Car Sales Tax Calculator Subtract what you sold the car for. There are also local taxes up to 1 which will vary depending on region. Standard antique registrationlicense plate fee is a one-time 40 fee. The bill requires the vehicles to be at least 25 years old to qualify for the cap. Buying a new vehicle is a taxable transaction in Kansas and payment is due the day you register your ride.

Wyandotte County Kansas Vehicle Bill Of Sale Download Fillable Pdf Templateroller You must assess between January 1 and May 31 each year. And Notice 09-10 Cash for Clunkers aka Car Allowance Rebate System CARS. Notice 09-05 Manufacturers rebate on the purchase or lease of new motor vehicles. Antique license plates do not need to be renewed property taxes will still be due annually. Subtract what you sold the car for.

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool If a personalized antique plate is requested there will be an 4550 charge in addition to the 40 registration fee. So when you negotiate a price with the dealer youll have to factor in the extra money youll need to spend in sales tax. Sales tax is due at the 75 Anytown sales tax rate on 27910. An improvement is deemed as anything thats long term such as new paint or new stereo speakers. Antique registration means that you pay 25 once for an inspection and never have to pay for it.

Cash For Cars Kansas City Get 480 11 000 Cash For Car Vehicle Sales-Page 2 Publication KS-1520 Kansas Exemption Certificate. Antique registration means that you pay 25 once for an inspection and never have to pay for it. Antique license plates do not need to be renewed property taxes will still be due annually. Fee for antique plate. Cost- 4500 registration fee in addition to personal property tax and sales tax.

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool Cost- 4500 registration fee in addition to personal property tax and sales tax. Delaware gets good marks for sales tax but it does charge a Documentation Fee which is 45 percent of the vehicle sale price or the NADA value whichever is higher. Decals for Antique Vehicle Model Year Tags. In most cases the tax is fixed at 1200. Once the documents are submitted and the fees are paid you will be issued new license plates for your vehicle.

The Great Flood Of 1993 Our Red X In Riverside Missouri Riverside Through The Looking Glass Flood However for new model year vehicles the assessed value is based on a percentage of MSRP and pricing guide values are used for subsequent years. In addition there is a county registration fee of 500 for a. Antique registration means that you pay 25 once for an inspection and never have to pay for it. 4000 registration fee is a one-time fee. Physical proof of insurance on the vehicle showing issue and expiration date will be required.

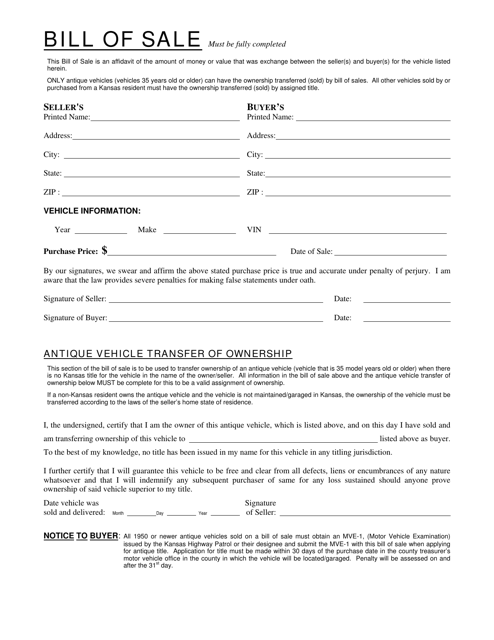

Sales Tax On Cars And Vehicles In Kansas You asked 1 how the statutes define an antique vehicle for purposes of the property tax assessment limit on such vehicles and 2 for a legislative history of the assessment limit law. Bill of Sale is a affidavit which must include vehicle identification number year make signature of seller and name and address of the buyer The county will collect the sales tax. Notice 09-05 Manufacturers rebate on the purchase or lease of new motor vehicles. Sales taxes on cars are often hefty so you may try to avoid paying them. Payment for taxes and fees.

Definition Satirical Essay In 2021 Essay Topics Case Study Essay Sales tax if not already paid. Ordinarily your tax liability would be 3000 on a purchase like that. To get the difference you will need to contact the County Treasurer and give them the year make and model of the new as well as the old vehicle and tell them you need to know the difference in the taxes. But if the original sales price plus the improvements add up to 8000 and you sell the car for 10000 youll have to pay capital gains tax on your 2000 profit. And Notice 09-10 Cash for Clunkers aka Car Allowance Rebate System CARS.

Pdf The Big Three Of The Auto Industry Analyzing And Predicting Performance The law allows tax assessors to require vehicle owners to provide reasonable documentation that the vehicle is an antique motor vehicle as described above. There are also local taxes up to 1 which will vary depending on region. Ordinarily your tax liability would be 3000 on a purchase like that. The law allows tax assessors to require vehicle owners to provide reasonable documentation that the vehicle is an antique motor vehicle as described above. Depending on your state this may include sales tax use tax andor wheel tax.

Cash For Cars Kansas City Get 480 11 000 Cash For Car The fee to transfer is 1250 plus the difference in the property tax. You must assess between January 1 and May 31 each year. But if the original sales price plus the improvements add up to 8000 and you sell the car for 10000 youll have to pay capital gains tax on your 2000 profit. In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. This document mainly just validates the purchase price of the deal although if the sale involves an antique vehiclethat is one thats 35 years old or olderthis form can officially transfer ownership without a title.

Cash For Cars Kansas City Get 480 11 000 Cash For Car Decals for Antique Vehicle Model Year Tags. When buying an automobile if one trades in a car the state deducts the price of the trade when calculating the sales tax to be paid on the automobile eg purchasing a 40000 car and trading a 10000 car a person would be taxed on the difference of 30000 only not the full amount of the new vehicle. So when you negotiate a price with the dealer youll have to factor in the extra money youll need to spend in sales tax. The law allows tax assessors to require vehicle owners to provide reasonable documentation that the vehicle is an antique motor vehicle as described above. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles.

Events Greeley County Kansas In addition there is a county registration fee of 500 for a. Fee for antique plate. The dealer also charges an administrative fee of 75 for processing the title paper work etc and installs a spoiler for an additional 950. The law allows tax assessors to require vehicle owners to provide reasonable documentation that the vehicle is an antique motor vehicle as described above. Antique vehicles are taxed annually as personal property just as any other vehicle.

Cash For Cars Kansas City Get 480 11 000 Cash For Car Most counties offer online assessment. Antique vehicles are taxed annually as personal property just as any other vehicle. Legal terms used in this publication. The law allows tax assessors to require vehicle owners to provide reasonable documentation that the vehicle is an antique motor vehicle as described above. In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees.

Vehicles Johnson County Kansas Buying a used car especially from a private seller can be a. Call it what you like thats still a tax. Look up your county assessors office. If not a Kansas Dealer a bill of sale is required is amount of sale is not on the back of title. Registration fee varies by county.

The States With The Lowest Car Tax The Motley Fool The tax on their sales tax returns. However for new model year vehicles the assessed value is based on a percentage of MSRP and pricing guide values are used for subsequent years. 4000 registration fee is a one-time fee. The state general sales tax rate of Kansas is 65. There are also local taxes up to 1 which will vary depending on region.