kansas sales tax antique cars Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. Owners of these vehicles pay a one-time 40 registration fee and 17 annually in.

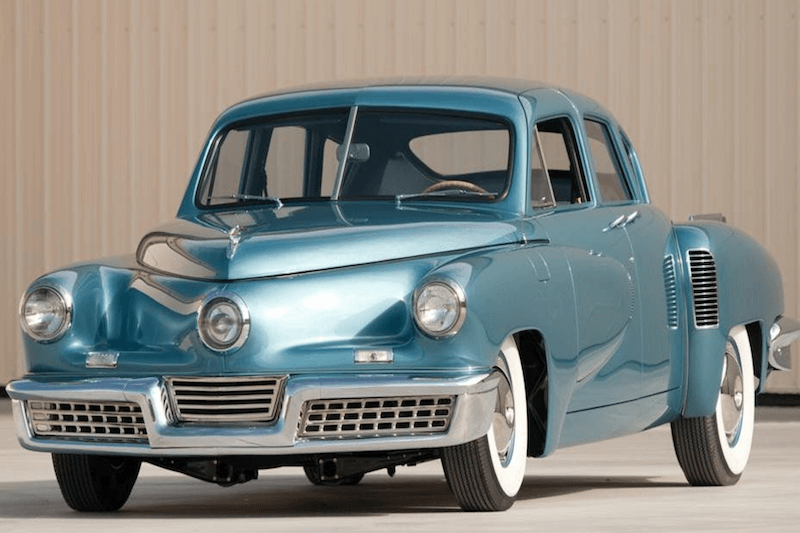

Kansas Sales Tax Antique Cars, Owners of these vehicles pay a one-time 40 registration fee and 17 annually in. 111 S Cherry St Olathe KS 66061 913-715-5000 TDD. 1934 Ford 3-Window Coupe.

Quotes About Old Cars Quotesgram From quotesgram.com

Quotes About Old Cars Quotesgram From quotesgram.com

Standard antique registrationlicense plate fee is a one-time 40 fee. Classic AntiqueClassic inventory - find local listings from private owners and dealers in the state of Kansas. The final step in the application process for special intereststreet rods or antique license plates is to provide payment for the applicable fees.

1934 Ford 3-Window Coupe.

There are also local taxes up to 1 which will vary depending on region. Classic Cars For Sale in. Or a classic American muscle car hot rods or some other type of old car. Once the vehicle is registered you will be mailed a personal property tax statement every year in December. Annual registration is 1700 after plate is issued.

Another Article :

Epingle Sur Cars Antique license plates do not need to be renewed property taxes will still be due annually. In addition there is a county registration fee of 500 for a total of 1700. Annual registration is 1700 after plate is issued. In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. Looking to buy a classic car or truck in Kansas.

Pin On Little Trucks In most cases the tax is fixed at 1200. 4550 registration fee plus tag fee in addition to personal property taxes and sales tax. Kansas sales tax law treats a lease as a series of recurring sales to the lessee with each installment being treated as a separate sales transaction that is subject to sales tax. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. Antique vehicles are taxed annually as personal property just as any other vehicle.

Cheap Ebay Used Cars For Sale In 2021 Cars For Sale Automatic Cars For Sale Used Cars Dodge City KS Sales Tax Rate. Typically you will receive this tax bill toward the end of the calendar year with your real estate and personal property tax statements. Shop millions of cars from over 21000 dealers and find the perfect car. Pin On Classic Cars. Derby KS Sales Tax Rate.

The Time Travellers Business Standard News Arkansas City KS Sales Tax Rate. There are also local taxes up to 1 which will vary depending on region. Looking to buy a classic car or truck in Kansas. Dodge City KS Sales Tax Rate. Antique vehicles 1950 or newer sold on a bill of sale require an inspection.

1992 Dodge Spirit Plymouth Acclaim Dodge Spirit Automotive Marketing Car Ads In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. Related Kansas Statutes KSA 8-172. In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. Classics on Autotrader has a huge selection of classic cars muscle cars rare and exotic vehicles and more. Under the bill any car more than 35 years old would be eligible for antique registration regardless of any updates made to the car or the age of parts on the car.

Quotes About Old Cars Quotesgram 1972 Pontiac Lemans GT. 800-766-3777 Johnson County KS USA 2021. In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. In addition there is a county registration fee of 500 for a total of 1700. Fee for antique plate.

Title Registration Classic Cars Vs Antiques Vs Vintage Etags Vehicle Registration Title Services Driven By Technology 1934 Ford 3-Window Coupe. In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. Andover KS Sales Tax Rate. Related Kansas Statutes KSA 8-172. Volunteers had been scrambling after getting word from the Kansas Department of Revenue that the nonprofit would have to pay a 99 percent sales tax something from which the group has always been.

Someone Paid Only 5 400 For This 1955 Armstrong Siddeley Sapphire 346 Carscoops Classic Cars British Classic Cars Singer Cars Sales tax is required to be charged on each installment unless the entire lease price is. 1972 Pontiac LeMans GT I bought this car in Cheyenne Wyoming a couple of years ago. Or a classic American muscle car hot rods or some other type of old car. Antique vehicles are taxed annually as personal property just as any other vehicle. Andover KS Sales Tax Rate.

1950 Lincoln Sport Sedan For Sale Gateway Classic Cars 25049 Current proof of insurance. In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. There are also local taxes up to 1 which will vary depending on region. Typically you will receive this tax bill toward the end of the calendar year with your real estate and personal property tax statements. How much is sales tax on a car in Johnson County KS.

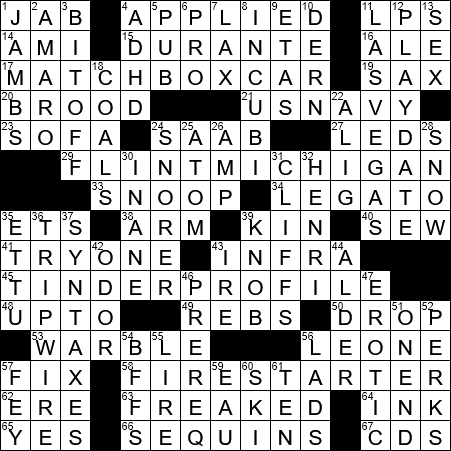

An Auction Of Vintage Classic Cars By Handhclassics Issuu 1934 Ford 3-Window Coupe. KANSAS SALES TAX Kansas is one of 45 states plus the District of Columbia that levy a sales and the companion compensating use tax. Total Sales Tax Rate. Related Kansas Statutes KSA 8-172. Classic cars have a rolling tax exemption ie vehicles manufactured more than 40 years before 1 January of that year are automatically exempt from sales tax and vehicles used for certain types of forestry and agriculture are as well.

1947 Hudson Super 8 Antique Cars Old Classic Cars Vintage Cars Fees to Register a Street Rod or Antique Vehicle in Kansas. Antique car or classic car enthusiasts can help you connect with classic car dealers and private sellers to find your ideal classic car. Sales tax is required to be charged on each installment unless the entire lease price is. Kansas Sales Tax Antique Cars 24 Mar 2021 Everything for sale on this page is located in the state of Kansas. 4000 registration fee is a one-time fee.

Mg Magnette Mkiv Classic Cars British British Cars Classic Cars Vintage Sales tax rates in the county currently range from 7725 to 9725from which 1225 comes to Johnson County Government 65 goes to the state of Kansas and between 1 and 2 go to the city where the purchase is made. Typically you will receive this tax bill toward the end of the calendar year with your real estate and personal property tax statements. Once the vehicle is registered you will be mailed a personal property tax statement every year in December. Antique license plates do not need to be renewed property taxes will still be due annually. Andover KS Sales Tax Rate.

What Green Regulations Could Mean For Classics Hagerty Insider Kansas sales tax law treats a lease as a series of recurring sales to the lessee with each installment being treated as a separate sales transaction that is subject to sales tax. In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. How much is sales tax on a car in Johnson County KS. Sales tax is required to be charged on each installment unless the entire lease price is. Total Sales Tax Rate.

What Are Historic License Plates How To Get One For Your Car The News Wheel Volunteers had been scrambling after getting word from the Kansas Department of Revenue that the nonprofit would have to pay a 99 percent sales tax something from which the group has always been. Sales tax may also be due at the time you title and register the vehicle. Risk and rewards of ownership. Antique vehicles 1950 or newer sold on a bill of sale require an inspection. Kansas sales tax law treats a lease as a series of recurring sales to the lessee with each installment being treated as a separate sales transaction that is subject to sales tax.

Classic Cars For Sale In Philadelphia Gateway Classic Cars Related Kansas Statutes KSA 8-172. Antique vehicles are taxed annually as personal property just as any other vehicle. Arkansas City KS Sales Tax Rate. 4000 registration fee is a one-time fee. In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees.